In personal finance, I focus on big wins. I didn’t think this included credit card rewards. I was wrong.

Update: The following post was written in August 2021. As of October 18, 2021, Chase is no longer offering this 100,000 point bonus on Chase Sapphire, but the rest of the concepts below are the same.

Welcome offers grant so many points at once, they dwarf what anyone could earn at a normal pace of spending in a year with even the best credit cards. Furthermore, points from travel credit cards convert to multiples of their cash value. When you combine welcome offers with incredible conversion rates, you get a legitimately powerful tool to add to your financial arsenal.

Some prerequisite knowledge is required, so we’ll break this into a few parts.

Welcome Offers are Big Wins

Earning a few pennies back on your groceries isn’t exciting, but earning over a thousand dollars at once certainly is.

The cash value of a reward point is generally equal to a penny. Many credit cards have incredible welcome offers worth up to a thousand dollars in points (when you see 100,000 points, that means $1,000…or more, as we’ll see below). I don’t mean in some estimated “value;” I mean real currency. You can convert those points into dollars pretty easily.

I’m not advocating you just open and close credit cards constantly for welcome offers. This will hurt your credit score and damage your standing as a customer with these companies. Furthermore, these welcome offers come with spending requirements, so it’s difficult to meet multiple welcome offers at the same time.

However, when great ones come along, they are worth it. In fact, some say you should always be working on at least one welcome offer. This means doing some staggering and planning ahead, but credit card companies are always innovating, which means there are always new credit cards waiting for you with juicy welcome offers.

Chase and the 5/24 Rule

Chase offers some of the best credit cards, welcome offers, and most flexible and valuable reward systems.

Unfortunately, they also have the most restrictive card opening rule. To stop users from gaming their welcome offers, you cannot open more than 5 credit cards within a 24-month period. That means if you opened 5 credit cards (with ANY company, not necessarily Chase) in the past 24 months, they will outright reject you for a credit card with 100% certainty.

You can read more about the history and details of this rule from Nerd Wallet.

The consequence of this rule is that we want our first 5 credit cards to ideally be from Chase, because other companies do not have this rule.

Furthermore, Chase is always among the “best” credit card lists, and their rewards points (Ultimate Rewards) are consistently among the most flexible and valuable available. You can always get incredible value out of their ecosystem.

That’s why, assuming you are under the 5/24 rule, a Chase offer is absolutely where you want to start.

Chase Sapphire Conversion Rates

Chase’s premium travel rewards cards are called Sapphire and are loaded with benefits. They have two versions: their flagship Sapphire Reserve ($550 annual fee) and their midrange Sapphire Preferred ($95 annual fee).

You cannot hold both at once, but you wouldn’t want to, because their benefits entirely overlap. Normally (and this is true for any credit card company), with even a little travel, you’ll get the most value out of the more premium card due to the perks. Chase Sapphire is no different. You can read about all their features and bonuses here.

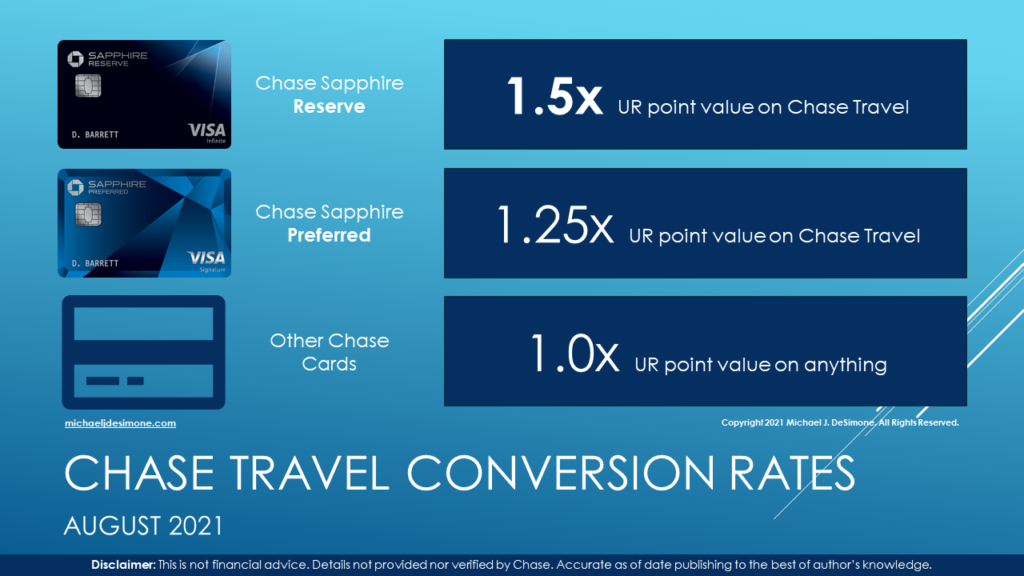

On top of those other perks, here are the conversion values for those Ultimate Rewards (UR) points when booked through Chase Travel:

The cheat code is the 1.5x conversion rate with the Reserve on points used through the Chase Travel portal. The portal is like Expedia or any other hotel and flight aggregator; you can book pretty much your entire trip through it at competitive market prices.

Chase’s Ultimate Rewards (UR) points are already competitive with other banks’ points when used outside of Chase Travel (at 1.0x) because that is how people traditionally use points. That means the conversion rates are purely a bonus. Chase just wants you to build a habit of booking through their system, so they offer a big incentive to use it. To put this in dollar terms, if you have 100,000 points and you convert them through a Reserve card (1.5x), you’ll have $1,500 worth of travel.

The way they can “get you” on these premium travel cards is that most of your everyday purchases only earn 1 point per dollar spent. However, we have a way around that too. There are plenty of other Chase credit cards that earn the same UR points, but they offer a higher accrual rate and no annual fee, including:

- Chase Freedom Flex: rotating 5x points on categories that vary each quarter

- Chase Freedom Unlimited: 3x points on pharmacy/dining and 1.5x points on all else

- Several Chase Business cards, for which you may be eligible

Note that you obviously cannot use these other cards to complete the spending requirement on your Sapphire welcome offer, but you’ll pass that relatively quickly.

Using any of these cards to accrue points on everyday purchases, you can then transfer them to your Sapphire card to use for rewards. Therefore, the value of the Sapphire conversion rates is pure arbitrage if you simply use the right card for the right purpose, and always be collecting UR points. (However, increasing your point earnings rate is relatively insignificant when compared to the size of the welcome offers. Don’t let this optimization scare you off; you don’t need to open multiple cards if you don’t want to.)

Transferring Ultimate Rewards (UR) points

One thing that makes UR the most flexible point reward is its transferability between accounts. Through Chase’s “Combine Rewards” feature, you can transfer points freely and instantly between any of your cards. So, if you have a Sapphire, you’ll obviously transfer them all to the Sapphire before booking anything, and then enjoy the 1.25x or 1.5x multiple.

The other lesser-known transfer option is to another member of your household. (Yes, you two must live in the same household, or Chase may void all of your hard-earned points.) So, if either you or your significant other has a Sapphire Reserve, you can both accumulate points with any of the other cards, and then transfer points over to the Reserve holder to get all points converted at 1.5x! This is the basis for the optimized strategy below (which definitely unfairly favors couples!).

You don’t have to worry about this until well after you’ve completed the welcome offer, but for a step-by-step guide for transferring points, see: How to transfer Chase Ultimate Rewards points between accounts (The Points Guy).

Update September 2021: The option add a household member no longer appears online, so you just have to add the card first by calling Chase. Then, you can transfer points online to the new card like usual. Instructions are here: You can still add a Chase household member card on the phone (The Points Guy).

The Current Welcome Offer and Strategy

Finally, now that we know why we care about welcome offers, why we definitely want to start with Chase, and how to use Chase’s Ultimate Rewards (UR) program to get even more out of our welcome offer, here it is:

The offer on the Reserve is 60,000 points for a $550/year card.

The offer on the Preferred is 100,000 points on a $95/year card.

Both have the same $4,000 spending requirement within the first three months. Remember that the Reserve offers the 1.5x conversion rate, while the Preferred only offers 1.25x.

This is a somewhat strange situation. A 100,000 point offer is not unheard of from business cards or premium cards like Amex Platinum, but it is rare for a midrange card like the Preferred.

Remember that each person can only have one type of Sapphire card at a time. You are also not eligible for the welcome offer if you have opened one or the other in the past 24 months.

Let’s take a look at how to maximize these offers.

Single Cardholder Strategy

If you are single and are not that into the whole credit card points game, you should just do this very simple thing: open a Chase Sapphire Preferred and meet the spending requirement. You will still get those 100,000 UR points and be able to convert them at 1.25x, which is not too shabby. That’s $1,250 for $95; well over a thousand dollar profit. That’s worth doing even if you hate this.

If you are single and want to go for the long-term play, you have two options. The safe option is to ignore the big welcome offer for the Sapphire Preferred. The Sapphire Reserve is a much better card. Furthermore, it makes your other cards (Chase Freedoms or Business cards) more valuable due to the 1.5x conversion. The 60,000 UR point welcome offer is not bad…that’s still $900 with your conversion rate…but they sometimes run better ones. The second option is to open the Preferred for the big bonus, forgo the Reserve benefits for a few months, and later ask Chase to upgrade you to a Reserve. However, this is not guaranteed to work and certainly would not come with another welcome offer.

Couples Strategy – OPTIMAL (Must Live with Significant Other)

I’m so lucky to be in this situation, so I want to share it with anyone who could benefit. If you live with your significant other, you can have it all. Consider this your reward for not killing each other during quarantine.

The couples’ strategy is straightforward:

- One person has the Chase Sapphire Reserve for that 1.5x conversion rate

- One person opens the Chase Sapphire Preferred for the 100,000 point welcome offer

Once the Sapphire Preferred holder completes the spending requirement, he or she simply transfers the 100,000 UR points over to the Sapphire Reserve holder (as explained above) to get 1.5x on them. That’s your $1,500 value!

Go take that free vacation. You’ve earned it.

A note on point value

Many experts get even more than 1.5x of value out of 100,000 UR points. For example, The Points Guy values them at 2.0/cent, meaning 100,000 UR points have $2,000 of value to him. That’s because of how good he is at finding deals and working hotel and airline programs. UR points are super flexible; they can be transferred to a few dozen hotels and airlines to take advantage of their award bookings.

However, the Chase Travel 1.5x conversion rate is a hard floor for value. Those points become real dollars at 150% of their value when booking travel through Chase. So even if you aren’t a points guru, you are still getting value like one (almost).

A note on authorized users

Even if you didn’t open a Sapphire yourself in the past 24 months, if you became an “authorized user” on one during that time, it likely voids your eligibility for these welcome offers. Furthermore, if you want to share your Reserve perks by adding an authorized user, it’s unclear if you can do so while that user also holds a Preferred.

However, note that if you are trying to maximize points, that means maximizing bonus offers, which generally means avoiding authorized users (at least until you are much farther into your credit card journey).

A note on travel-specific cards

The world of hotels, airlines, and credit cards are highly connected and reward the most loyal and dedicated users of all three generously. If you do not travel at all, you won’t be able to maximize this system.

However, I think most people should probably be using travel cards, even if you only travel very little. Not only are their rewards more valuable, but they will passively nudge you to travel more, leading to a more enriching life. Having money for the sake of having money is missing the point of it all a little bit. Regardless, a welcome offer like this can be converted to cash fairly easily if that’s more your style. The only thing you’ll miss is the fantastic conversion rates.

A brief lecture on using your credit card responsibly

This information is only usable by those who pay their entire statement balance in full every month. Credit card rewards, even welcome offers, do not come close to beating out credit card interest rates. Never carry a credit card balance. Never get into credit card debt.

Link to offer

Here’s a link to the offers on both Sapphires: Sapphire | Credit Cards | Chase.com

TLDR: Credit card welcome offers are too valuable to ignore in an optimal personal finance strategy. Chase’s current offer of over $1,000 of value in a midrange $95 annual fee card is a prime example. Chase rewards are so flexible that you can transfer them to another member of your household and take advantage of multiple welcome offers at once while both utilizing their optimal conversion rates.

Were you able to score a “free” vacation with this offer, or do you know of even better ones out there?

Comment below, find me on Twitter @mjdesimone, or email me your thoughts at mike@michaeljdesimone.com. I read every email.

Cover photo credit: uponarriving.com

I am not affiliated with Chase and receive no remuneration whether or not you sign up for an account. The offer details were not reviewed by Chase for accuracy. See Chase’s website for full and up-to-date terms. Information is accurate to the best of the author’s knowledge as of the time of its publishing (August 2021).

LOCALIZATION: This was written primarily for US residents. Factors unique to other countries may not have been considered.

DISCLAIMER: This is education, not financial advice. All investment/financial opinions expressed are my own and not related to my employer or any other person or entity. They are based on personal research and experience and are intended as educational material.

I am not your financial advisor. I am not a registered investment, legal, or tax advisor or a broker/dealer. This content was not created for or catered to any individual person or group, so no one should treat it as personalized content. All content was accurate and up to date as of the publishing of the article to the best of my knowledge.

Do your own research. This content is provided for informational purposes only. It is important to do your own analysis before making any investment based on your own personal circumstances. You should seek the advice of a financial professional and independently verify any claims made before making any investment decision.

Investments may lose money. All investments involve risk and you should be sure you understand your exposure and tolerance for that risk before making an investment decision. Past performance is not a guarantee of future return, nor is it necessarily indicative of future performance. The value of your investments will fluctuate and you may gain or lose money.