“What do I do with my money?”

It is by far the most common question I get from friends, family, coworkers, acquaintances, and even strangers. I usually answer by drawing a simple diagram.

The problem with personal finance advice is no one can give you a simple answer. So, people tune out and do nothing. I mean, have you seen the personal finance flow chart on Reddit? Yikes. While it’s mostly accurate information, who can bother with all that?

A dead simple answer

Managing your money doesn’t have to be complicated.

Everyone has a checking account. You don’t need to feel as guilty about keeping some extra money in there as everyone makes you feel, and you certainly do not need a savings account.

You do need to automate your finances and always be investing.

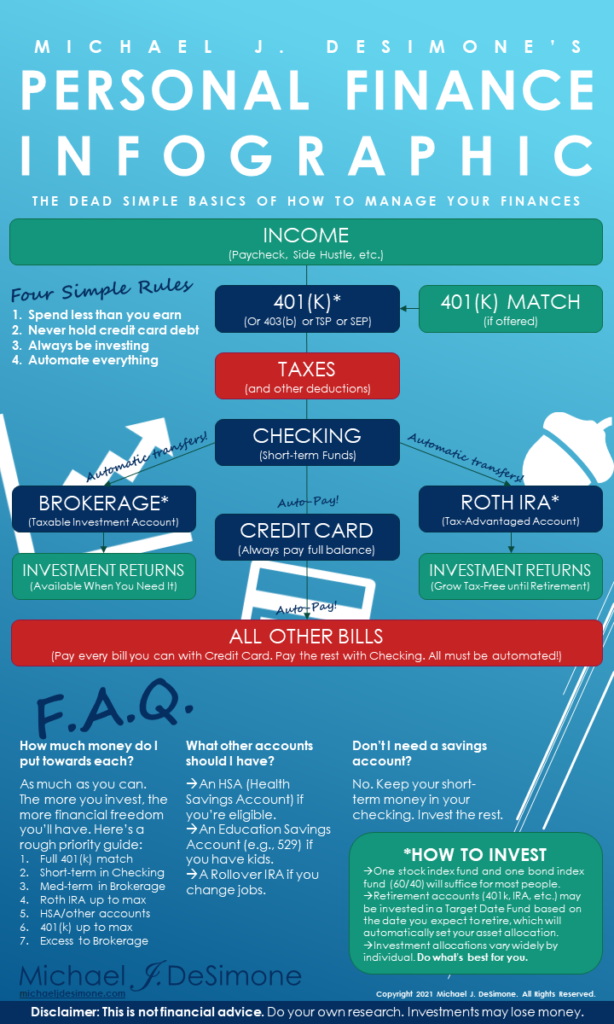

In this diagram, I lay out how three simple investment accounts, which you can set and forget, will put you on an easy path to building wealth. Most people should have one general account (a taxable brokerage, for use before retirement) and two retirement accounts (one employer account such as 401k, and one personal account such as a Roth IRA).

I’m not even going to bother lecturing you on the specifics; just know that it’s only these three simple accounts that lead most people to financial freedom and peace of mind. There’s not much else to it. I also provide some very high-level advice on what to invest in (it should go without saying that you can’t just move money into those accounts without investing it…that’s the same as leaving it in your checking account).

Finally, you need to have at least one credit card (I have multiple and like to take advantage of great offers) and use it for every expense possible. This does not mean you can spend any more money than before; your balance should always be paid off in full each month and should never be higher than the amount of money you have available. Treat it like cash, but with the added benefits of tracking your spending, automating your bills, granting consumer protection, and earning rewards.

Without further ado, here it is, my dead simple personal finance infographic. This is the same framework I have provided countless friends and family members (although usually drawn hastily on a napkin or paper while berating them, not all pretty like this):

My Personal Finance Infographic: the Dead Simple Basics of How to Manage Your Finances

Sometimes it’s not so simple

If you can get these basics down, you’re on the right path.

The reason personal finance advice is so complicated is that everyone has unique situations. I’ve been asked about all the wildest things, like how to fund the life of a parent, how to pay off $100,000 of student debt, what to do about life insurance or annuities, what to do with a massive cash windfall, how to set up an account for a child’s education, when to start collecting social security, etc.

The dead-simple diagram above does not cover these topics. But, it does set up a framework that can handle almost anything. Get these basics down and stop fretting about your unique situation. After you do this, you can dig in and research how to handle the other money issues that come up.

Note: I am assuming you are not in credit card debt. Do not ever get into credit card debt. If you are already, I am sorry, and I applaud you for trying to read up on personal finance and improve your situation. I recommend you try Ramit Sethi’s comprehensive post on this if you need help getting out of it.

Where to learn more

There’s no shortage of information on the internet about this. Everyone has an opinion about what to do with money, but few of them have any credentials or reason to trust them (I do, but that doesn’t mean you should blindly trust me either).

The best places to look (in my opinion) are the Reddit r/personalfinance wiki (don’t bother reading the posts), Bogleheads wiki (based on the teachings of John Bogle, founder of Vanguard and inventor of the Index fund), and Ramit Sethi’s website (bestselling personal finance author with a scammy-sounding site name but years of solid advice).

All I’ve done is combine their conclusions with my own experience and industry expertise, and pared that down to a single page anyone could understand.

Do you have all five of these accounts set up? If not, what is holding you back?

Comment below, find me on Twitter @mjdesimone, or email me your thoughts at mike@michaeljdesimone.com. I read every email.

LOCALIZATION: This was written primarily for US residents. Factors unique to other countries may not have been considered.

DISCLAIMER: This is education, not financial advice. All investment/financial opinions expressed are my own and not related to my employer or any other person or entity. They are based on personal research and experience and are intended as educational material.

I am not your financial advisor. I am not a registered investment, legal, or tax advisor or a broker/dealer. This content was not created for or catered to any individual person or group, so no one should treat it as personalized content. All content was accurate and up to date as of the publishing of the article to the best of my knowledge.

Do your own research. This content is provided for informational purposes only. It is important to do your own analysis before making any investment based on your own personal circumstances. You should seek the advice of a financial professional and independently verify any claims made before making any investment decision.

Investments may lose money. All investments involve risk and you should be sure you understand your exposure and tolerance for that risk before making an investment decision. Past performance is not a guarantee of future return, nor is it necessarily indicative of future performance. The value of your investments will fluctuate and you may gain or lose money.